Financial health is extra than just having sufficient money; it’s about achieving a nation of properly-being in which you experience confident approximately your financial future. In today’s speedy-paced global, in which monetary pressures are ever-present, achieving economic health has grow to be a essential thing of ordinary well-being.

Understanding Financial Wellness

Financial nicely-being goes beyond in fact having a large financial group balance. It consists of hanging a stability among your profits and charges, handling debt correctly, building financial financial savings, and planning for the future. A holistic approach to economic nicely-being includes the subsequent key components:

- Budgeting: Create an in depth rate range outlining your income and costs. Track your spending behavior to find out areas in which you could reduce once more and allocate extra price range within the route of financial financial savings and investments.

- Emergency Fund: Build an emergency fund to cowl surprising prices collectively with clinical bills, car renovation, or undertaking loss. Aim to store at the least three to 6 months’ honestly well worth of residing prices in a liquid account.

- Debt Management: Develop a technique to repay excessive-hobby money owed which encompass credit score score score card balances and personal loans. Consider debt consolidation or refinancing options to decrease interest expenses and simplify compensation.

- Savings and Investments: Set precise economic desires consisting of buying a home, investment education, or retiring outcomes. Invest in severa assets collectively with shares, bonds, mutual finances, and real property to increase your wealth over the years.

- Insurance Coverage: Protect your self and your own family with true enough insurance insurance, consisting of medical health insurance, lifestyles coverage, incapacity coverage, and assets coverage. Review your rules often to ensure they meet your evolving wishes.

- Retirement Planning: Plan for retirement early by contributing to retirement accounts such as 401(k)s, IRAs, or pension plans. Take advantage of employer matching contributions and tax-deferred growth opportunities.

- Financial Education: Continuously educate yourself about personal finance topics such as budgeting, investing, taxes, and estate planning. Attend workshops, read books, and consult with financial advisors to enhance your financial literacy.

Tips for Improving Financial Wellness

- Set SMART Goals: Define Specific, Measurable, Achievable, Relevant, and Time-bound goals to keep yourself motivated and on track towards financial success.

- Live Below Your Means: Avoid lifestyle inflation by spending less than you earn. Adopt frugal habits such as cooking at home, using public transportation, and shopping for discounts.

- Automate Savings and Payments: Set up automatic transfers to your savings account and automate bill payments to avoid late fees and missed payments.

- Review and Adjust Your Budget Regularly: Monitor your budget regularly and make adjustments as needed to accommodate changes in your income, expenses, and financial goals.

- Seek Professional Advice When Needed: Don’t hesitate to seek guidance from financial professionals such as certified financial planners, tax advisors, and estate planners to address complex financial issues.

- Practice Self-Care: Prioritize your physical and mental well-being, as they are closely linked to your financial health. Practice stress-reducing activities such as exercise, meditation, and adequate sleep.

- Stay Informed: Stay abreast of economic trends, regulatory changes, and market developments that may impact your financial situation. Knowledge is power when it comes to making informed financial decisions.

The Importance of Financial Wellness

Achieving monetary health is crucial for individuals and families to thrive. It offers a sense of security and stability, reduces pressure associated with cash matters, and permits people to pursue their desires and goals without economic constraints protecting them back.

Factors Affecting Financial Wellness

Several factors influence an individual’s financial wellness, including:

Income

Having a stable and sufficient income is fundamental to financial well-being. It ensures that basic needs are met and provides the foundation for achieving financial goals.

Expenses

Managing expenses effectively is crucial for maintaining financial wellness. Keeping track of spending habits and prioritizing needs over wants can help individuals live within their means.

Debt Management

Debt can be a significant obstacle to financial wellness. Effective debt management strategies, such as paying off high-interest debt and avoiding unnecessary borrowing, are essential for improving financial well-being.

Savings and Investments

Building emergency savings and investing for the future are key components of financial wellness. Having a financial cushion allows individuals to weather unexpected expenses, while investments help grow wealth over time.

Financial Literacy

Understanding basic financial concepts and making informed financial decisions is essential for achieving and maintaining financial wellness. Improving financial literacy through education and resources empowers individuals to take control of their financial lives.

Future of financial wellness

The future of financial wellness promises to be exciting and transformative, with technology, personalization, and holistic approaches leading the way. Here are some key trends to watch:

Personalization and AI:

- AI-powered tools: Using individual financial data, algorithms will offer tailored budgeting advice, investment recommendations, and retirement planning. Imagine a virtual financial assistant guiding you through complex decisions.

- Hyper-personalized solutions: Programs will adapt to your unique needs, age, goals, and risk tolerance, ensuring relevant and actionable guidance.

Technology integration:

- Seamless integration: Financial tools will seamlessly integrate with daily life, automatically tracking expenses, suggesting saving opportunities, and offering real-time insights. Your budget app might suggest saving based on upcoming bills, for example.

- Gamification and engagement: Engaging apps and games will make financial learning and planning fun and motivating, encouraging healthy financial habits.

Holistic approach:

- Financial wellness as part of well-being: Financial health will be recognized as integral to overall well-being, leading to programs that integrate physical, mental, and social aspects with financial planning. Imagine employee wellness programs combining financial workshops with stress management techniques.

- Focus on mental health: The link between financial stress and mental health will be acknowledged, leading to programs that address both simultaneously. Financial advisors might be trained to recognize signs of anxiety and offer mental health resources.

Accessibility and inclusion:

- Financial education for all: Resources and programs will be more accessible and inclusive, addressing the needs of diverse populations and socio-economic backgrounds. Imagine financial literacy workshops offered in multiple languages or tailored to specific demographics.

- Focus on underserved communities: Initiatives will target underserved communities, ensuring everyone has the opportunity to achieve financial wellness.

Other potential developments:

- Rise of alternative banking models: New entrants, like robo-advisors and fintech companies, will continue to challenge traditional banks, offering innovative financial products and services.

- Impact of changing work landscape: With evolving employment models like freelancing and gig work, financial planning will need to adapt to offer security and stability.

- Data privacy and security: As financial data becomes more integrated, robust data privacy and security measures will be crucial to maintain trust and confidence.

The future of financial wellness is full of possibilities, offering the potential for individuals and communities to achieve greater financial security and peace of mind. However, ensuring these benefits reach everyone requires addressing existing inequalities and promoting responsible development alongside technological advancements.

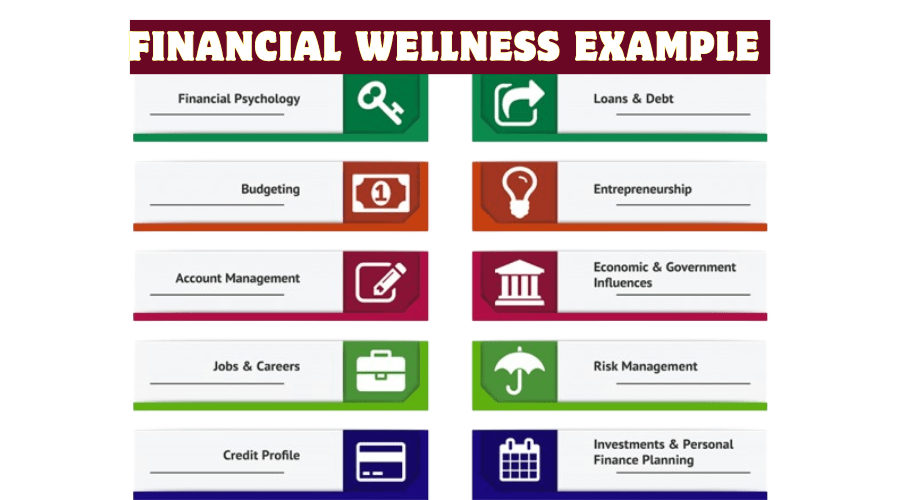

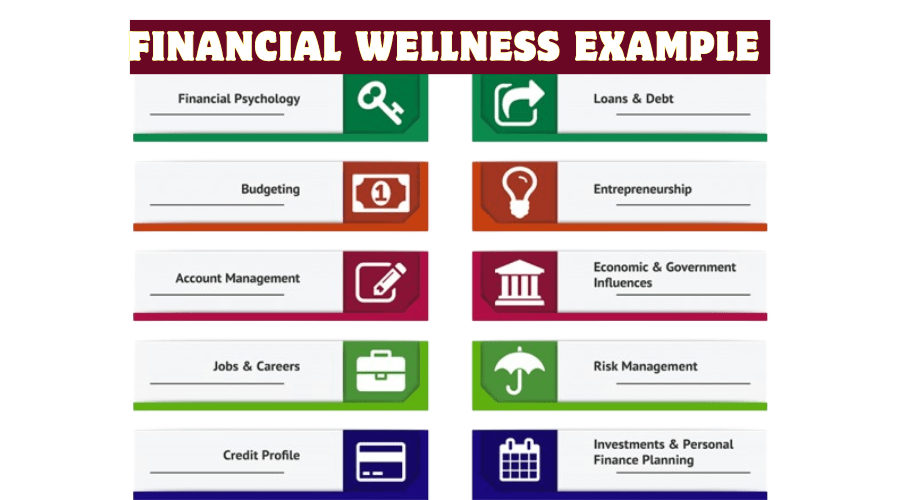

Financial wellness examples

| Financial Wellness Category | Examples |

|---|---|

| Budgeting | Creating a monthly budget and tracking expenses |

| Using budgeting apps or spreadsheets | |

| Limiting discretionary spending | |

| Saving and Investing | Setting up automatic transfers to savings |

| Investing in retirement accounts (e.g., 401(k)) | |

| Diversifying investment portfolio | |

| Debt Management | Paying off high-interest debts |

| Consolidating debts for lower interest rates | |

| Avoiding unnecessary debt accumulation | |

| Emergency Fund | Saving 3-6 months’ worth of living expenses |

| Keeping emergency fund in liquid accounts | |

| Replenishing emergency fund after use | |

| Retirement Planning | Calculating retirement savings needs |

| Contributing regularly to retirement accounts | |

| Reviewing and adjusting retirement plan | |

| Financial Education | Reading personal finance books and articles |

| Attending financial workshops or webinars | |

| Taking online courses on financial literacy | |

| Insurance Coverage | Reviewing and updating insurance policies |

| Understanding coverage and deductibles | |

| Comparing insurance quotes for best rates | |

| Regular Financial Check-Ups | Reviewing financial goals and progress |

| Adjusting budget and savings goals accordingly | |

| Monitoring investment performance | |

| Lifestyle Choices | Living below means to avoid overspending |

| Prioritizing needs over wants | |

| Practicing mindful spending habits | |

| Seeking Professional Advice | Consulting with financial advisors |

| Getting tax advice for optimal planning | |

| Working with estate planners for wealth transfer |

Strategies for Improving Financial Wellness

Improving financial wellness requires proactive steps and strategies, including:

Budgeting

Creating a budget helps individuals track their income and expenses, identify areas for saving, and prioritize financial goals.

Debt Reduction

Paying off debt systematically, starting with high-interest debt, can alleviate financial stress and free up resources for saving and investing.

Saving and Investing

Consistently saving a portion of income and investing wisely can build wealth and provide financial security for the future.

Financial Education

Continuously learning about personal finance topics and seeking professional advice can enhance financial literacy and improve decision-making.

Implementing Financial Wellness Programs

Employers and organizations play a vital role in promoting financial wellness among their employees and members. Implementing financial wellness programs, such as workshops, counseling services, and retirement planning resources, can help individuals improve their financial literacy and make positive financial choices.

Impact of Financial Wellness on Mental Health

Financial stress can take a toll on mental health, leading to anxiety, depression, and other adverse effects. By achieving financial wellness, individuals can reduce financial-related stressors and improve their overall well-being.

Case Studies: Successful Financial Wellness Initiatives

Several organizations have successfully implemented financial wellness initiatives, leading to positive outcomes for their employees or members. Case studies highlighting these initiatives can provide insights and inspiration for others looking to improve financial wellness.

Financial wellness facts

Here is the table of Financial wellness facts

| Fact | Description |

|---|---|

| It’s personal and multi-faceted | Financial wellness involves feeling in control and having a plan, not just having enough money. |

| Financial stress is prevalent | Many people experience financial stress, impacting their mental and physical health. |

| Financial literacy matters | Understanding personal finance concepts empowers people to make informed decisions. |

| Not just about income | Managing your income wisely can lead to financial security even on a modest income. |

| Workplace impact | Financial stress can affect employee productivity and job satisfaction. |

| It’s achievable | Many resources and tools are available to help people improve their financial wellness. |

| It improves overall well-being | Managing your finances effectively can reduce stress and boost confidence. |

| It empowers you | Developing financial literacy can give you greater control over your life and future. |

Conclusion

Financial wellness is a journey that requires commitment, discipline, and ongoing effort. By understanding the factors that influence financial well-being and implementing strategies to improve it, individuals can achieve greater financial stability, peace of mind, and overall well-being.

Financial Wellness FAQs:

What is financial wellness?

Financial wellness means feeling in control of your money and confident about your financial future. It’s not just about having a lot of money, but about living within your means, managing your debt, and saving for your goals.

What are financial wellness tools?

Many tools can help you manage your finances, like budgeting apps, debt calculators, investment simulators, and credit score trackers.

What are the principles of financial wellness?

Some key principles include:

- Living within your means: Don’t spend more than you earn.

- Building an emergency fund: Aim for 3-6 months of living expenses.

- Paying down debt: Focus on high-interest debt first.

- Saving for your goals: Retirement, education, down payment, etc.

- Investing for the future: Grow your wealth over time.

- Protecting your income and assets: Consider insurance and risk management.

What is personal financial wellbeing?

Personal financial wellbeing is about your unique financial situation and goals. It encompasses your income, expenses, debt, savings, investments, and other financial assets.

How do you get financial wellness?

It’s a journey, not a destination. Here are some steps:

- Track your spending: Understand where your money goes.

- Create a budget: Plan your income and expenses.

- Pay off debt: Reduce your financial burden.

- Start saving: Build your emergency fund and other goals.

- Invest: Grow your wealth for the future.

- Protect yourself: Consider insurance and risk management.

- Seek professional help: Consult a financial advisor if needed.

Why is financial wellbeing important?

Financial stress can impact your overall health and well-being. Financial wellness can lead to:

- Reduced stress and anxiety

- Improved physical and mental health

- Greater sense of control and security

- Ability to achieve your goals

What are the 5 steps to financial wellbeing?

The steps mentioned above are key, but you can find various 5-step approaches:

- Assess, Define, Plan, Track, Adjust.

- Track, Plan, Save, Invest, Protect.

- Earn, Budget, Manage Debt, Build Assets, Plan for Future.

What are the 4 elements of financial wellbeing?

While specific models differ, some frameworks define four elements:

- Financial security: Having enough money for basic needs and emergencies.

- Financial freedom: Ability to pursue goals and choices without undue financial constraints.

- Financial resilience: Ability to withstand financial shocks and recover quickly.

- Financial confidence: Feeling knowledgeable and empowered about your finances.

What are financial values?

Your personal values influence your financial decisions. Examples include:

- Security: Desire for stability and peace of mind.

- Freedom: Ability to make choices and pursue goals.

- Generosity: Giving back to others or supporting causes.

- Experience: Prioritizing travel, hobbies, or personal growth.

What are the 5 elements of wellbeing?

Wellbeing goes beyond finances, encompassing various dimensions:

- Physical: Exercise, nutrition, sleep.

- Emotional: Managing stress, building healthy relationships.

- Mental: Cognitive function, mental health, mindfulness.

- Social: Connections with family, friends, community.

- Financial: Feeling in control of your money and future.

What are the 6 steps to control your finances?

Focus on the principles mentioned earlier, like creating a budget, paying off debt, saving, investing, and protecting yourself. Consistency and tracking progress are key.

What are the six steps for making good financial decisions?

- Define your goals: What are you saving or investing for?

- Gather information: Research options and risks.

- Consider your values: Align your decisions with your priorities.

- Seek professional advice: Consult a financial advisor if needed.

- Compare options: Evaluate different approaches carefully.

- Monitor and adjust: Review your decisions and adapt as needed.

What are financial habits?

- Regular actions that impact your finances, like:

- Tracking spending: Being aware of where your money goes.

- Saving automatically: Set up automated transfers to savings accounts.

- Paying bills on time: Avoid late fees and maintain good credit.

- Cooking at home: Reduce dining out expenses.

- Comparing prices: Get the best value for your money.

What are good money habits?

- Budgeting: Track income and expenses to understand your financial flow.

- Saving: Build an emergency fund and save for long-term goals.

- Debt management: Minimize high-interest debt and make timely payments.

- Investing: Grow your wealth with low-risk options based on your goals.

- Spending consciously: Avoid impulse purchases and prioritize needs over wants.

How do I start financially?

- Assess your current situation: Track income, expenses, and debts.

- Set realistic goals: Short-term (emergency fund) and long-term (retirement).

- Create a budget: Allocate income for expenses, savings, and debt repayment.

- Seek resources: Free online tools, financial education courses, and advisors.

What is the link between financial and mental wellness?

Financial stress can negatively impact mental health. Financial stability contributes to peace of mind and overall well-being.

Is financial a component of wellness?

Absolutely! Financial wellness alongside physical, mental, emotional, social, and environmental well-being contributes to a balanced and fulfilling life.

What are the seven dimensions of wellness financial?

- Earn: Develop earning potential through education, skills, and career growth.

- Spend: Manage expenses wisely and avoid unnecessary debt.

- Save: Build an emergency fund and plan for future needs.

- Borrow: Use credit responsibly and only when necessary.

- Invest: Grow wealth for long-term goals like retirement.

- Protect: Secure yourself and your assets with insurance.

- Give: Share your financial resources with others through charity or philanthropy.

TotalInfo4U: Your Ultimate Source for Comprehensive Knowledge